State Board of Accountancy Adopts New Educational Guidelines for CPA Licensure, Effective October 1

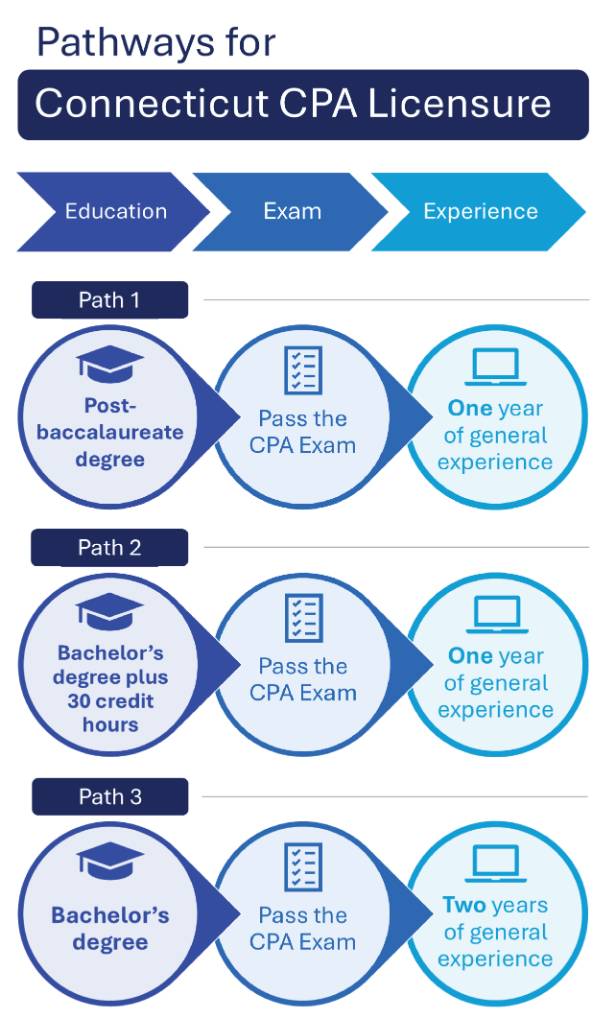

Effective October 1, 2025, Connecticut adopted three flexible pathways to CPA licensure, expanding access to the profession while maintaining the integrity of the credential through education, examination, and experience.

The three pathways are:

- Pathway 1: Post-baccalaureate degree, passage of the CPA Exam, and one year of general experience.

- Pathway 2: Bachelor’s degree plus 30 credit hours, passage of the CPA Exam, and one year of general experience.

- Pathway 3: Bachelor’s degree, passage of the CPA Exam, and two years of general experience.

Guidelines for Educational Credits

At its September 25 Special Meeting, the Connecticut State Board of Accountancy approved draft regulations outlining new educational requirements to support these pathways. These draft regulations will serve as guidelines to be used by the Department of Consumer Protection until the new regulations are finalized.

The draft regulations are subject to change before final adoption, and any concerns identified during the approval process may prompt further review and modification of the guidelines by the Board.

Under the new guidelines:

- Candidates must complete 27 credits in Accounting and 24 credits in Economics and Business Administration other than Accounting.

- References to general education have been removed.

- The 120-credit hour requirement to sit for the CPA Exam remains unchanged.

CPA Licensing Alignment in the Northeast and Nationwide

Connecticut’s changes reflect a broader effort to strengthen the CPA pipeline and align state laws with the evolving profession. Flexible pathways, including those for bachelor’s degree holders, are being rapidly adopted nationwide, with all 50 states and three jurisdictions expected to complete the transition within the next five years, if not sooner.

While the Connecticut legislature has finished its work for this calendar year, many other legislatures are still in session with pathways modification bills expected to move rapidly.

Regional highlights of licensing changes include:

- Massachusetts: Draft bill is before the legislature and is expected to pass this year.

- Rhode Island: Legislation is expected next year.

- Maine: Legislation is expected next year.

- Vermont: Legislation is expected next year.

- New York: Passed legislature, awaiting Governor’s signature.

- New Jersey: Currently before legislature.

- Maryland: Legislation is expected next year.

- Pennsylvania: Passed and signed by Governor.

You can track the conversation in all licensing jurisdictions online >>