Membership Categories and Dues Structure

Where do you fit?

Certified Member: Individuals holding CPA certification.

A Certified Member is someone who holds a certificate from the State of Connecticut as a Certified Public Accountant or is a Certified Public Accountant of another state, territory, or possession of the United States (including the District of Columbia) who does not hold a Connecticut certificate.

Professional Colleague: Select non-CPAs.

A Professional Colleague is someone who is not a Certified Public Accountant and meets one or more of the following categories:

- CPA firm employee. A person employed in a professional capacity by an individual or entity qualified in accordance with the law or regulations of a U.S. jurisdiction to perform audit or other attest services, tax or consulting services (“CPA firm”) shall be eligible to apply for membership as a CPA firm employee.

- Industry/non-CPA employee. A person not employed in a CPA firm, but whose employment may include but is not limited to industry, government, a not-for-profit organization, an educational institution, or a business entity other than a CPA firm or a company described in sub-paragraph (1) of this paragraph and who provides or facilitates accounting services or advice to one's employer or to the client(s) of one's employer in any and all matters related to accounting, human resources, financial, management, tax, technology, or consulting services, or the recording of financial data or information or the preparation or presentation of financial statements, shall be eligible to apply for membership as an industry/non-CPA employee.

- Academic associate. A member of the faculty of a college or university offering academic credit that qualifies toward meeting the

curriculum requirements necessary to take the CPA examination in a U.S. jurisdiction who teaches accounting, auditing, taxation, technology or other field of interest to the CPA community shall be eligible to apply for membership as an academic associate.

The Board of Directors will establish the criteria by which Professional Colleagues evidence their qualification for membership.

Professional Colleagues will not have the right to vote on issues requiring the vote of the Society's membership and will not be eligible to serve as a director, an officer, a member of the Nominating Committee, or a member of the Audit Committee.

International Member: CPA equivalent from outside the United States.

An International Member is the equivalent of a Certified Public Accountant of any country other than the United States. Any questions of eligibility as an International Member is decided by the Board of Directors in its sole and absolute discretion. International Members have the same rights as Certified Members.

Student Member: A college student taking accounting courses.

A Student Member is:

- a student who is:

a. currently enrolled full-time at an accredited college or university, accredited community college, or accredited junior college;

b. taking accounting courses; and

c. a resident of Connecticut or is attending an accredited college or university, accredited community college, or accredited junior college in Connecticut, or - a student who holds a bachelor's degree from an accredited college or university, but is not currently pursuing the additional thirty (30) credit hours required to sit for the CPA exam; or CTCPA Constitution and Bylaws

- a candidate for the CPA examination who has not yet passed the examination.

Any Student Member who holds a bachelor's degree from an accredited college or university may retain that status for a period of up to one year from the date that the student received his or her degree; the Board of Directors may grant a one-year extension at its discretion.

Student Members will not have voting rights.

How much does CTCPA membership cost?

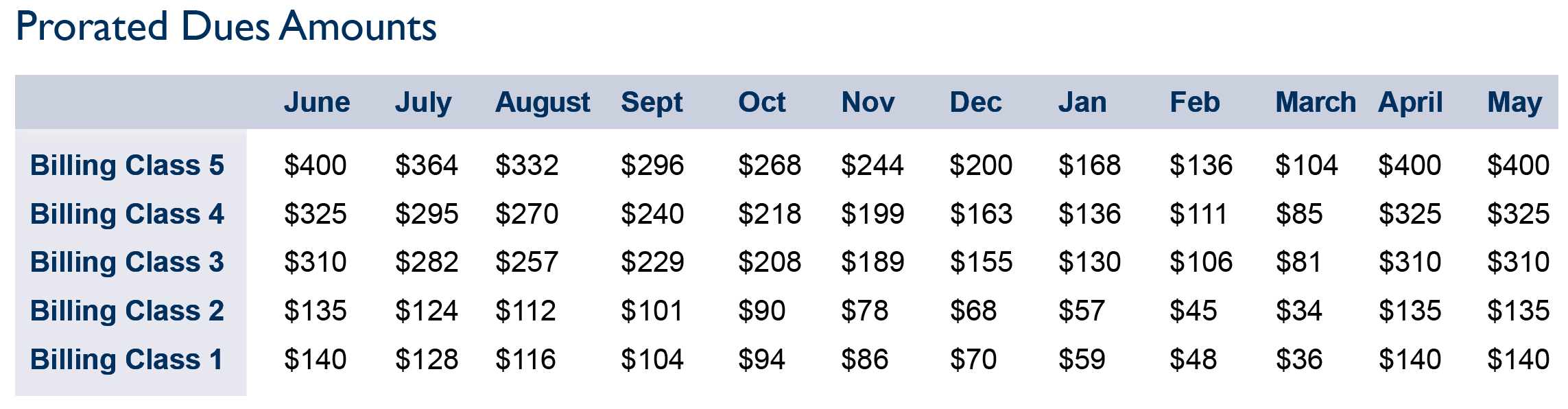

The following billing codes are based upon your status on March 31, 2025.

For 2025-2026, 95% of dues payments are deductible for most members as an ordinary and necessary business expense.

Contributions to the scholarship fund are tax deductible.

CPA Firm Owner

Any Connecticut firm owner who is a Certified Member or Professional Colleague engaged in the practice of public accounting.

Billing Class 5

Dues are: $400.

CPA

(Non-Owner)

Any Certified Member who is:

(a) An individual employed in any capacity in Connecticut,

(b) A resident employed outside of Connecticut , or

(c) An equivalent of a CPA from another country. country.

Billing Class 4

Dues are: $325.

Professional Colleague

(Non-Owner)

Any Professional Colleague who is:

(a) An individual employed in any capacity in Connecticut or

(b) A resident employed outside of Connecticut.

Billing Class 3

Dues are: $310.

Fully Retired

Any Certified Member or Professional Colleague fully retired from all employment.

Billing Class 2

Dues are: $135.

Out-of-State

Any Certified Member or Professional Colleague who is a non-resident employed outside of Connecticut.

Billing Class 1

Dues are: $140.

Student Member

A college student taking accounting courses.

Dues are: FREE!

Life Member

Any member who has paid dues to the CTCPA for 25 years, has reached his or her 65th birthday, and is fully retired from all employment. Annual verification is required.

Dues are: waived.

50-Year Member

Any member who has paid dues to the CTCPA for 50 years.

Dues are: waived.