All in the Family: The Comer CPAs

April 17, 2023

Thomas Comer, CPA chuckles when he talks about his family.

“I just wanted an exit strategy!”

And an exit strategy he got – in spades. The managing member of Comer & Company, CPA's, LLC currently works with his son Jonathan – also a CPA – while his wife Anne – also a CPA – works as Director of Operations with CRC Insurance Services, Inc. The couple's eldest son, Evan, is currently a Senior Manager in KPMG's Mergers & Acquisitions Tax practice ... and, yes, he also happens to be a CPA.

Altogether, the family of four has clocked more than 60 years with the CPA credential and CTCPA membership.

Tom's Story

Tom Comer got an early start on a finance career watching his father, the treasurer (which would now be considered the CFO position) of a local manufacturing company.

“My dad would take me to work with him once a month when he had to close the company's books. Although I realize now it was to get me out of my mom's hair,” Tom remembered. “I thought it was neat! He had this big machine he'd be banging on with these big green sheets with numbers on them. He was also the treasurer of almost every organization in East Haddam, so I thought that was cool, too. I probably wanted to be a CPA before I could spell it.”

After two years at Middlesex Community College studying business administration, Tom enlisted into the U.S. Air Force for four years during the Vietnam era. During this time, he took classes on base before finishing his degree (courtesy of the GI Bill) at Central Connecticut State University and, ultimately, earned his CPA credential.

A brief stint with the Big 8 led to the realization that a small firm may be more to his liking. After a year he moved to Dayton Piercey & Knapp, CPAs, a small firm in Middletown. When all the firm's other partners retired, Tom became the sole owner; the firm, which he renamed Comer & Company, continues to operate out of that same historical building on Main Street in Middletown.

To this day, he still sees a number of those clients he worked with back in his early days.

It's those connections with clients who've become friends and family that Tom values more than anything. “It's just all about relationships and how many interesting people I've met during my career,” he said.

Anne's Story

Once upon a time, Anne worked as an office manager for that small firm in Middletown … where she met, fell in love with, and married her boss, Tom. For several years, Anne stayed home and raised their two boys.

When the boys were in middle school, Anne decided she wanted to finish her college degree and get her CPA license. She always loved working in the accounting office; now she wanted to be a part of the profession.

Tom remembers her words clearly. “I'd like to go back to school and become a CPA … the plus side is, if something happens to you, we have continuality for either Evan or Jonathan if they want the firm.” Proudly, Tom noted, “She got right to it and never missed a beat at home with our family, or school ... she graduated first in her class. I believe her hard work rubbed off on our boys.”

Anne completed her degree at Central Connecticut State University full-time – with students who were, essentially, her sons' ages. She quickly stepped into a mentor role with many of her peers. “I remember a student in my accounting class saying, ‘My advisor said I'm not good in math so I shouldn't continue with an accounting degree.'”

Anne remembers telling them, “Calculators and computers do the math. For accounting, it's about putting the puzzle pieces together, interpreting tax law, and research.”

“We often get asked ‘is accounting a good major?' We tell everyone that you can't go wrong with it,” Anne explained. “Every business has accounting needs at its core, which means understanding accounting gives you an edge, no matter where your future takes you.”

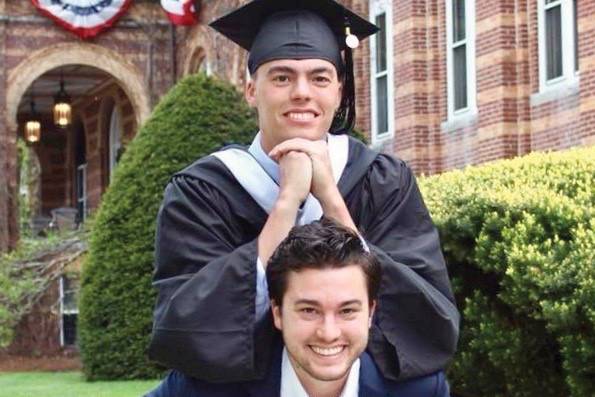

Evan's Story

Evan's origin story is strikingly similar to that of his father's.

“My first real word, apart from Dada, was ‘money,'” he laughed. “I would sit at the base of my father's desk when he'd be working at home during busy season. The spool of tape from his calculator would overflow off his desk and I would play with that. I guess you could say the accounting profession impacted me at a very early age.”

Becoming a CPA was always a goal of Evan's while growing up; he took as many accounting and business electives in high school as he could before heading to Bentley University to study corporate finance and accounting.

He received his Master's in Taxation at Bentley and passed the CPA Exam before settling in at a substantially larger firm than the rest of the family: KPMG LLP in Boston, where he's been for seven years. The pandemic presented him with the opportunity to work remotely, and Evan recently moved back to Connecticut.

“What I really like about public accounting is that you can, for the most part, control your career path and trajectory – with the right skillset, motivation, and hard work, becoming a partner is certainly possible,” Evan said.

“Working at KPMG, one of the Big 4 public accounting firms, has been a wonderful experience and I'm proud to have spent the last seven years of my career here ... It has flown by. What draws me to public accounting, specifically KPMG and the Big 4, are the opportunities to work on new and exciting projects and clients, national resources to enhance your technical skills, and the amazing people and teams I work with on a day-to-day basis.”

“On top of all that, there's never a dull moment – whether it's working with a diverse set of clients across the world and multiple industries, researching technical tax issues, or discussing complex restructuring strategies with clients, the job keeps me on my toes,” he continued. “It feels like I learn something new every day that I work here, which, for me, is most important.”

Jonathan's Story

The family was prepared for the streak to end with Jonathan, but unfortunately, his childhood dream of being a weatherman wasn't meant to be! (Have no fear, his family reassures – he gets to put his forecasting skills to good use when the family goes out on their boat. Jonathan always knows the accurate weather.)

Jonathan was always very good at math and remembers solving math problems for fun over the summers growing up. His family encouraged him to pursue engineering and thought that was the plan; Tom was shocked when he peeked at his son's first college acceptance letter and noticed it was from a business school.

“When I was in high school, Evan would come home from college and all they would talk about was the latest tax code, and I just had enough and thought, I need to understand what you guys are talking about,” Jonathan laughed.

“Just seeing how successful both my parents were and how well my brother was doing starting off his career, I knew accounting would be a great option. I had the right skill set … Accounting is logic, with a little math, and a little law.”

Jonathan received his undergraduate degree from St. Anselm's College and went to the College of Charleston to receive his Master's in Accountancy.

He worked in South Carolina for a few years in public accounting while studying and taking the CPA Exam. He eventually moved back to Connecticut with his fiancé (now wife) Rebekah. After two summers working with his father, he began working full-time as a CPA at Comer & Company ... hoping to become partner one day soon.

60+ Years of CTCPA Membership

With so many years in the profession, the Comers have racked up decades of CTCPA membership. Tom, a regular professional development program attendee, remembers back to the days of longtime Executive Director Jack Brooks and the massive tax workshops held at the Aqua Turf Club.

“Walter Nunnallee and before that, Surgent … To bring in national presenters like that was just incredible,” he remembers. “The Aqua Turf would be filled with 300-400 people, then it was a mad scramble to the Wagon Room or the Glass Room to get to sit down first so you could eat. You'd then get to see other CPAs that you kind of grew up with in your profession. You would know them from either college or working with them with mutual clients – it was always a nice visit, too.”

Anne, too, has seen her network grow as she's become more involved. Following her recognition with a CTCPA Women's Award in 2021, Anne began a term on the Advisory Council in May of 2022. That leadership role has given her a front-row seat to witness more of the CTCPA's inner workings, including its advocacy efforts.

“A lot of people don't know the amount of work that CTCPA does behind the scenes, including all the work CTCPA does advocating for CPAs and their profession with the state legislature,” Anne said.

Anne and Tom were both in the audience at a Recognition Reception a few years ago when Evan, an Accounting Scholarship Foundation scholarship recipient, shared his story as the event's keynote speaker. While Evan spent most of the earlier part of his career in Boston, he's a strong believer in the new and young professionals' opportunities CTCPA offers.

“Networking is important at any point in your career, but especially early on,” Evan said. “You grow up with your peers. Those peers, if they start out in public accounting, they may go into private, and then possibly become your client ... This is something I see all the time – the accounting profession is such a small world and you'll likely cross paths with one another at some point. As you're growing up with your peers, the opportunity to share knowledge, best practices, and experiences is really special and invaluable.”

The CPA Legacy

Tom beams when he looks at his family today.

“On my side, being the beginning of this, I just can't believe it happened,” he marveled. He told his family, “Hopefully you guys know how proud I am of you – that you followed in my footsteps in the profession that I love.”

Evan recognizes his dad's hard work growing up, but also applauds the flexibility the profession and firm afforded him.

“When I was growing up, I saw my dad's flexibility in his work,” Evan said.

“Every single event – baseball and basketball games, jazz band concerts, karate classes – he was there. I thought at the time that was normal. It wasn't until I got older that I realized he put a lot of effort into coordinating his work schedule and planning around family events. Even busy season wouldn't stop him from making it to a beloved baseball game,” Evan continued.

“That said, for anyone who's unsure of entering accounting because they think the ‘work-life balance' will be uneven and mostly ‘work,' my response would be that the profession is extremely rewarding and no matter where you end up – public, private, self-employed – you'll still be able to experience the ‘life' part of the equation. My father is a perfect example of that.”

Tom agrees.

“It's been a great career and I'll be sorry when it ends.”

We've seen it time and time again – the CPA career path runs in families. Would you like to share your story?

Email Managing Editor Kirsten Piechota at kirstenp@ctcpas.org and let us know how the profession has shaped your family!

Anne was honored with a CTCPA Women's Award in the Distinguished Service category in 2021. Watch her inspiring video about what her role in the accounting profession means to her.