Tax Credit Transfers: The New Face of Renewable Energy Tax Equity

March 11, 2024

Tax Credit Transfers unlock an ~8-10% reduction in federal tax liability

By Jonathan Fishman, VLC System – Tax Credit Transfer Advisory

Introduction

The renewable energy finance landscape has undergone a transformative shift with the passage of the Inflation Reduction Act of 2022. Building on this legislation, IRS proposed guidance in June 2023 helped to establish the tax credit transfer market, thereby allowing corporate taxpayers to play a pivotal role in the clean energy revolution. In this article, we explore the historical context of Investment Tax Credits (ITC) and Production Tax Credits (PTC), traditional tax equity financing structures, and the new opportunity presented by tax credit transferability for small- and medium-sized corporations.

The ITC, PTC, and Traditional Tax Equity Structures

The ITC and PTC have long been cornerstones of incentivizing renewable energy investment in the US. The ITC, established in 2006, provides a percentage-based credit (typically 30%) on eligible expenditures for solar, wind, and other renewable energy projects. Meanwhile, the PTC, introduced in the early 1990s, offers a per-kilowatt-hour credit for the production of electricity from qualified renewable energy sources.

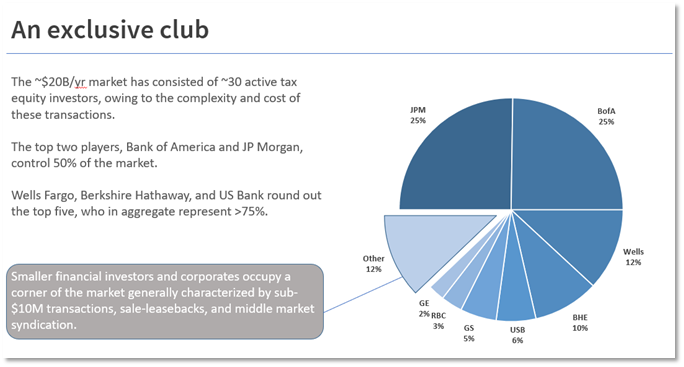

Historically, tax equity financing has been the primary mechanism for renewable energy project funding. Larger corporations with substantial tax liabilities would partner with renewable energy developers, essentially providing capital in exchange for the tax credits generated by the projects. This allowed these corporations to offset their tax liabilities and fostered the growth of the clean energy sector.

However, this model leaves smaller corporates on the sidelines, lacking the resources to participate actively in the clean energy revolution. The Inflation Reduction Act of 2022 and subsequent IRS guidance address this gap with the introduction of tax credit transferability.

A Game-Changing Opportunity

The key innovation introduced by the Inflation Reduction Act of 2022 is the ability to transfer tax credits to unrelated third parties. This groundbreaking change means that taxpayers can now purchase tax credits directly from clean energy projects using a transaction framework that is far less complicated and far less expensive than traditional tax equity structures.

Transferability presents an opportunity for corporations to reduce federal tax liability by ~8-10%, as 2023 and 2024 tax credits are currently available for ~$0.90 to ~$0.92 on the dollar. For individuals, trusts/estates, and personal service corporations, the same opportunity exists though passive activity rules would apply.

Conclusion

CPAs advising corporates and high net worth individuals now have a unique opportunity to guide clients toward reducing their federal tax liability through the purchase of renewable energy tax credits at a discount. This involves understanding the intricacies of the tax credit transferability process, identifying suitable projects, and structuring deals that align with the client's financial goals and business strategies.

VLC provides end-to-end buy-side deal support for tax credit transfers, including origination, due diligence, documentation, and execution. Jonathan Fishman can be reached at jonathan@vlcsystem.com or 401-787-5011.

Publicly announced tax credit transfer deals

› 16 Aug 2023 | Bank of America – Invenergy | $580M Section 45 credit transfer

› 2 Oct 2023 | Ashtrom – Investor Syndicate | $300M Section 45 credit transfer

› 10 Nov 2023 | Arevon – JP Morgan | $191M Section 48 credit transfer

› 27 Dec 2023 | First Solar – Fiserv | $700M Section 45X credit transfer

› 1 Feb 2024 | Vesper Energy – Investor Syndicate | $500M Section 45 credit transfer